Do you ever wonder how technology is creative as well as a disruptive force in the financial industry? On one hand, it is unlocking productivity while on the other it is forcing the firms to incorporate the elements that are attacking their profit. It is changing the way business is done and impacting the fintech industry by altering its role, structure, and environment simultaneously it is opening the companies to numerous opportunities. However, analysis and experts believe that the benefits clearly outweigh the cost.

A decade after the subprime crisis, financial organizations are managing to improve their capitalization and revenue by offering solutions that use insight, advanced analytics, and technology to meet the exponentially increasing expectations of the customer. The emergence of fintech is creating a new wave of innovation and is forcing the financial industry to reinvent itself.

It is not only capitalizing on technology to provide excellent customer experience but also resolving the prevailing issues faced by the financial industry. Regulations and technology are expecting a fundamental shift in the business model of the financial industry specifically banks. The banking sector is in the dilemma with innovative fintech and advanced technologies like blockchain that are disruptive.

The financial services firms too are facing a choice to create their own capabilities or partner with fintech to achieve its innovation initiatives. According to Gartner, a leading research firm 73% of financial institutions are facing the pressure to speed up, which can be mitigated with the help of technology. Thus, technology is taking a primary position in the financial industry to meet the marketplace needs.

Emerging Fintech Trends

The technological environment is providing a pragmatic roadmap to the financial industry. The companies are adopting integrated themes, advanced financial analytics, core and digital system, cloud computing, talent flexibility, and innovative culture to survive in the competitive world and offer excellent customer services. Therefore, the emerging trends in 2020 in the financial industry are:

Blockchain systems are something to be turned about

Blockchain is an ingenious invention that forms an integral part of the technological and operational infrastructure of the financial industry. The public ledger not only helps to make infrastructure less expensive but also makes many financial transactions and automated contractual agreements easier.

Embedding the Sharing Economy

With customers getting smarter about their choices, financial institutions are seeking to partner with new breed FinTech companies to drive its peer-to-peer transactions thereby alleviating the capital risk, reduce cost, and increase its physical distribution.

Hybrid cloud is creating a new wave

With cloud computing taking a front seat in the banking industry, many banks are actively seeking the perfect blend of traditional IT, private, and public clouds to address data security issues.

The Asian market will become the epicenter of innovation

The Asian market is becoming the central point that is driving technological innovations, therefore many financial institutions are planning to have their hubs in Asia which will deploy global and local markets.

Robotic Process Automation(RPA) and Artificial Intelligence(AI) to bank on

With rising labor costs, the financial institutions are looking towards RPA as a credible substitute. The use of thinking machines will help to reduce costs and simplify compliance. AI, on the other hand, is automating a huge amount of underwriting in the markets and detecting payment frauds.

Innovation and growth driving the transformation

Many financial institutions are outpacing their competitors and accelerating growth by funding innovation that helps in optimizing the costs, driving digital business transformation, and leading the employees to be confident when risks materialize.

Cyber-security continues to be on the risk management agenda

The traditional approach to risk management is no longer appropriate with the rising cyber threats. Advanced analytics, real-time monitoring, artificial intelligence, and other such tools will minimize the risk; however, expert says the change for better is unlikely in the coming years.

Evolving Fintech challenges

Rightly said, challenges are meant to be met and overcome, the financial industry recognizes the prevailing and potential challenges, that are changing the rules and if not addressed on time may result in substantial losses. These challenges will force the financial services institutions to revisit their plans to turn the existing situations into advantages.

IT operating model threatening the legacy system

The financial institutions are finding it difficult to balance their core functions and transformational initiatives. Besides this, technology is proprietary, so simply a blink of an eye can give a competitive advantage to the competitors. The legacy system, process, and relationship will continue to make innovation difficult, as new technology ramp-up the customer and market expectations.

Dynamic technology is forcing us to speed up

Cybersecurity, use of Big data, FinTech disruption, etc are a few of the challenges that the fintech startups are facing as it is moving towards digitalization. It is threatening the profitability, privacy of valuable data, reputation, and regulators.

Escalating regulatory compliance

Regulators are mandating the financial industry to spend a larger part of their discretionary budget on regulatory compliance, which is forcing them to assess and enhance their operations to keep the balance of technology and regulations.

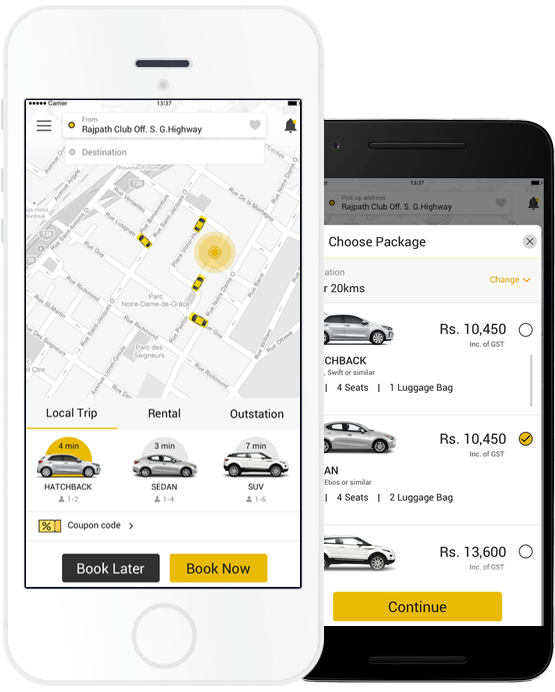

Rising customer expectations to win the market

This is a forefront challenge that the financial industry is facing in recent times. With the rising use of mobile devices and the internet, the customers are demanding a high level of services simultaneously with data security, which is making it difficult for the institutions to manage efficiently. Also, many customers are expecting a local presence, so the challenge related to scaling still persists.

Surpass the competition to establish the superiority

It is becoming challenging for fintech companies to promote growth and sustainable profit with low-interest rates. With rising competition, it is difficult to rebuild the asset quality and strengthen capital position with reliable revenue sources.

To conclude, the financial industry will need to rethink its risk management strategies to overcome technological challenges and meet customer expectations. They need to develop solutions that provide a strong foundation for current challenges and address future ones. The challenges themselves bring an opportunity, which if capitalized appropriately will take an organization to new heights and help them to secure a prominent place in the industry. The financial companies will have to develop their IT teams and ensure the smooth integration of technology into their business model to overcome some of the key challenges. No industry can survive without technology especially the financial industry is more vulnerable to changes in the digital arena. Agile or reliable the decision lies with the firms to cope with the omnichannel operations and using a host of technologies to exploit the unlimited opportunities it brings. Very precise and meticulous, the perfect blend of the traditional approach and modern technology will serve the assuaging purpose without a second thought.

Finance enthusiasts- let's take your innovation game to another level

Related Articles

Achieving Success Through Innovative Solutions

Transforming client businesses through state-of-the-art creativ